Technology Business Valuation

From web development to ecommerce, lets hone in on your industry sub-sector valuation multiples

Our Credentials

There is no one size fits all multiple for Technology Businesses

With EBITDA multiples that range from 4x to 20x, it pays to get an expert, 3rd party valuation assessment.

How does a technology (or e-commerce) business valuation differ from a standard business valuation?

- In addition to the standard asset, income, and market approach, it is essential that the valuation considers customer acquisition costs, monthly and annual recurring revenue, company growth trends,customer churn, and website traffic. This can make an enormous difference when determining the most appropriate EBITDA multiple, discount and growth rate for determining the fair market value of your business

Key Considerations When Valuing a Technology Company:

- What stage in the life cycle is your business in? Hyper Growth, steady growth, plateau?

- How do you obtain customers? Do you measure acquisition cost or lifetime value? Revenue by product, service, channel, partner?

- How do you structure customer contracts? What is your monthly recurring revenue/ annual recurring revenue?

- Do you actively measure and manage website traffic performance?

- Is there a management team in place outside of the owner?

- Are there any family members working in the business?

- How much do you invest in R&D, capital expenditures, launching new products, and/or growing sales into new categories or geographic regions?

- How is your business impacted by interest rates and exchange rates?

- For your specific industry, are competitors being acquired regularly, funded by new capital, or rolled up by Private Equity?

Technology companies differ in size, scope, and expertise. We have experience performing valuations for:

- E-Commerce

- Software Development

- Website Development

- Technology Management Consultants

- Hardware production, distribution, and retail

- IT Managed Service Provider (MSP)

- Break Fix IT Services Provider

- Monitoring & Hourly IT Services Provider

- Managed Security Solutions Provider (MSSP)

- Cloud Solutions Provider (CSP)

- Software As A Service (SaaS)

- Independent Software Vendors (ISV)

- Value Added Resellers (VARs)

- Sales Enablement and Productivity Software Solutions

Whether you are an ecommerce company or software as a service there are 5 key ways to improve your company’s valuation:

- Improve the overall percentage of revenue that is recurring – reliable, repeatable, dependable payment

- Reduce customer churn – bring on more customers (and revenue) than you lose

- Reduce the cost to acquire customers – make it easy for customers to sign up and make sure the sales channels are optimized for bringing on the right fit customers

- Reduce the friction to onboard, manage, and retain new customers – create standard operating procedures so that the customer experience is uniform and repeatable

Technology Business Valuation Report Options

Reports differ on your need and use case:

Broker’s Opinion of Value

Receiving an Opinion of value is ideal for exit planning, succession planning, wealth management planning. This is our main offering, and is used to determine a likely Sales Price on a business. This is performed by one of our technology business experts holding an MBA, CBI or NAVCA certification.

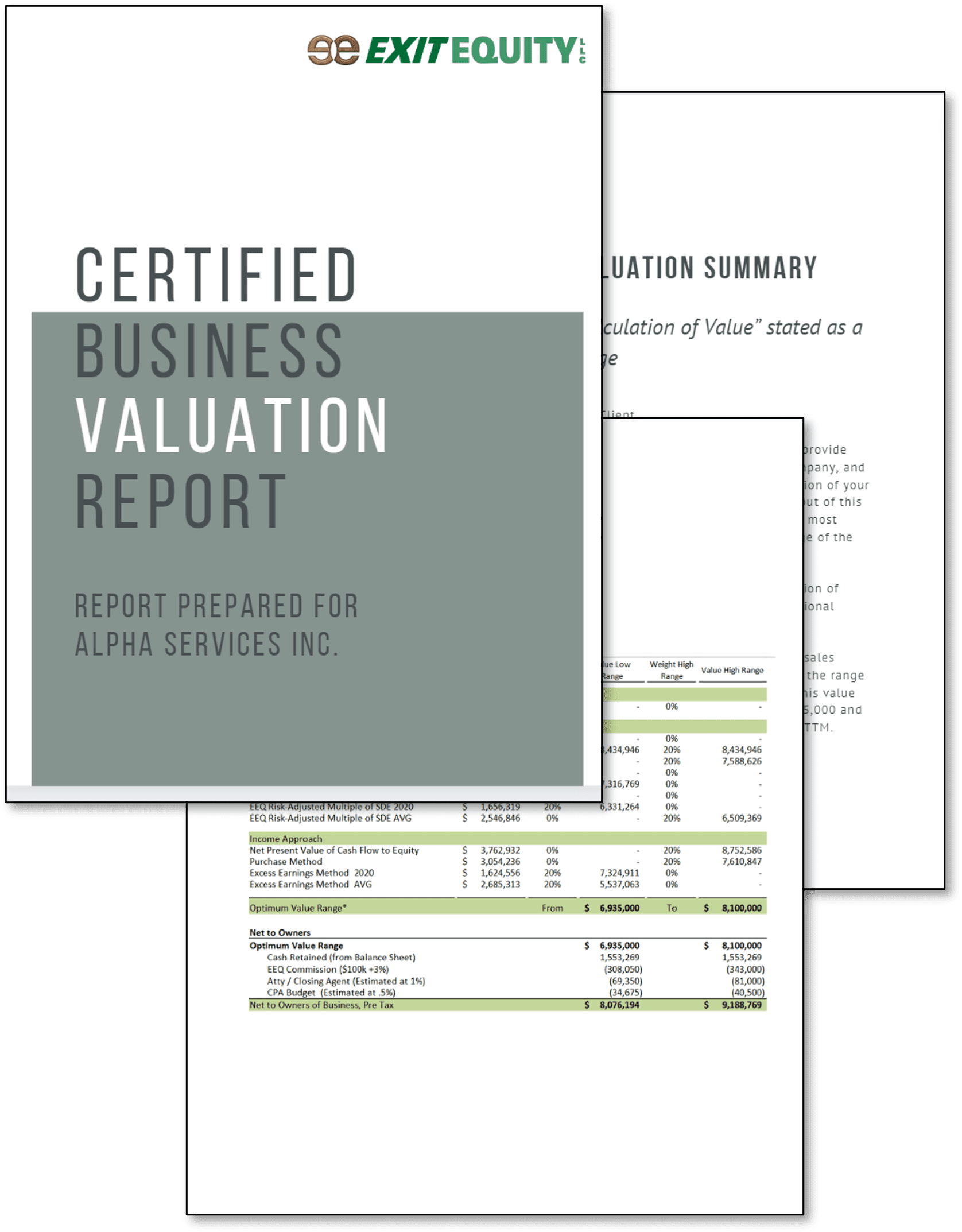

A Certified Business Valuation

Or a Conclusion of Value is performed by or NACVA Analyst. This is ideal for Tax Reporting, Shareholder Dispute, Compliance, and Legal Proceedings(i.e. Divorce, Trust, Estate) where the valuation may be evidence in an arbitration or court proceeding. This is only performed by our NAVCA Valuation Analysts.

With either valuation offering, you’ll receive:

- The Fair Market Value of your business (what your business will likely sell for out on the Open Market)

- The ‘Net-to-You’–what cash you will receive at the end of the transaction (more important than the Fair Market Value!)

- What expenses can be considered ‘add-backs’ (items that ultimately increase your valuation)

- What like-kind companies have sold for in the past

- Why methods for valuation are commonly used in your industry, and how they apply to you

- What value drivers help and hurt your business

- Ways to grow the value of your business

Benefits of Exit Equity’s Technology Business Valuation Services

- Strategy and tactics for estate planning, transitioning ownership to a family member/employee, or selling to a 3rd party

- Advice on how to improve your valuation multiples, discounted cash flow, and EBITDA (earnings before interest, taxes, depreciation, and amortization)

- Analysis on the most likely buyer type and approximate total available market (quantity) of potential buyers

- Guidance on potential process to sell both a technology company, property, or set up a long term lease to a new owner

- Tactics on reinvesting capital gains on the business sale into your next start-up

- The ultimate goal of the valuation is to remove doubt on what your company is worth and take control of the exit outcome!

- Take the first step and get started with your technology business valuation leveraging our wealth of experience as technology business brokers.

Don’t just take our word for it, learn more how an Exit Equity client found a strategic buyer to fund the next stage of company growth

Why Choose Exit Equity for a Technology Business Valuation?

Hear it from our past clients.

Our family run manufacturing business is ready for its next chapter and we were unclear on which steps to take and how to take them. [The team at Exit Equity] came in and quickly understood the complexities of the business, respected the family dynamics and was able to guide all parties through both a valuation and a successful transition.. The best decision we made for our family and our company was to work with Exit Equity.

– Julia Gilroy Family Owned Business

While no one can predict the future with absolute certainty, the rich detail and supporting context found in the Broker’s Opinion of Value provided by Exit Equity allowed us to confidently chart our course for the next couple of years. For the depth of research, the relevancy of the comparables, and the relative speed of delivery, we also feel that we received excellent value for the price. The fact that the valuation was such a successful process for us, we’d certainly consider Exit Equity again when we reach the next stage of this adventure.

-Digital Marketing Agency Founder

I called numerous brokers and was very impressed by the professionalism and thoroughness that Exit Equity provided us. They really took the time to understand our needs and the final valuation came at a fair representation of the work we put into it through the years. I would HIGHLY recommend their services to any business owners wanting to understand their numbers and what it would actually look like to sell a business.

– F.B. , founder and owner of a Business Services business

Take the Next Steps

Free and confidential consultation to determine what type of valuation is needed, price and process

Provide needed information to analyst—both quantitative and qualitative

1-2 informational meetings to understand your business and value drivers

Meet with your EEQ Expert for a 60-90 minute valuation presentation- a time to ask questions, identify actions and next steps based off your goals

Frequently Asked Questions Technology Business Valuation

Q. What types of technology businesses do you work with?

A.) We have technology M&A and transaction experience with web development, ecommerce, digital marketing consulting, software development, bio-tech, software as a service (Saas), payment processing, IT hardware, servicing, licensing, and distribution companies. We look forward to the day we can help a client with their AI, robotics, quantum computing, or flying car business.

Q.) Why are tech companies valued higher than a normal business?

A.) Tech companies typically experience much higher growth rates, lower margins, lower costs on capital expenditures/assets, and higher overall profitability, resulting in stronger valuations than other types of businesses.

Q. Why is it difficult to value an early stage company?

A.) WRONG! An SBA loan is not transferable or assignable. The loan has a personal guarantee on it and it must be paid off prior to selling a business. If you thought that your business is worth $1.5M, but you have a $800,000 loan, that means you need to pay the $800k and your asset sale / purchase agreement will net you $700,000 (before any transaction fees).

Q. How much does a valuation cost?

A.) Exit Equity offers a firm fixed price for a valuation. A typical valuation takes between 15 and 30 hours, at times up to 45 hours. The total amount of hours needed to complete the valuation depends on the complexity of the business (messy books, multiple subsidiaries, multiple currencies, etc), the type of valuation, and the qualification level of the analyst required to complete an accurate and robust valuation. Once a client needs assessment has been completed, our team can quickly prepare a quotation for a valuation.

Q. I see that I can receive a free valuation through other parties and apps. Why do you charge a fee?

A.) Every business is different, each has its own unique set of challenges and history. We produce bespoke valuations for each client based on market conditions, financial statements, current threats, and opportunities to grow. The typical valuation takes between 20 and 30 hours to complete.

We charge a fee to fairly compensate our staff for the work and knowledge it takes to complete the valuation. Like all things in life, you get what you pay for in terms of quality and customer service when the price is set to zero.

Q. What valuation methodologies do you use?

A.) We analyze a company’s value based on the cost, market, and income approach. Depending on the business and industry, this could include comparables businesses sold, rule of thumb multiples (EBITDA and seller’s discretionary earnings), real estate, the net present value of discounted free cash flow, and purchase method.

For technology companies, we may also consider monthly/annual recurring revenue, churn rate, customer acquisition cost, intellectual property/trade secrets, and customer lifetime value when determining the appropriate multiple.

Q. What is the typical output of a business valuation

A.) Video or in-person meeting to review the potential valuation range based on the methodologies named above, and a 10-20 page report summarizing our analysis. The report will include:

- The Fair Market Value of your business (open market value)

- ‘Net-to-You’–the cash you will receive at the end of the transaction (considering net working capital, long-term debt, and/or transaction fees)

- Expenses that can be considered ‘add-backs’ to improve the net income, EBITDA, and SDE calculations

- Comparable like-kind companies that have sold in the past

- Methods for the valuation range that are commonly used in your industry, and how they apply to you

- Value drivers help and hurt your business

- Strategies and tactics to grow the value of your business

Q. What is the typical input to create a business valuation?

A.) Annual and trailing 36-month income statement and balance sheets, tax returns, accounts receivable aging list, and a self-assessment questionnaire, One to two conference calls with the client to understand their business, industry, and market, add-backs, and intricacies of the input documents.

Other inputs may include real estate information, lease terms, segmentation of customers/revenue, top competitors, list of equipment assets, past and forecasted revenue and capital expenditures (CAPEX), terms of long-term debt, distributor agreements, supply agreements, and/or intellectual property.

Q. What other types of Business Valuations do you offer?

In addition to our Technology Business Valuations, we also offer Manufacturing Business Valuations and E-Commerce Business Valuations.