Key Highlights

- Buying a business in Portland, Oregon, often involves a competitive marketplace, making it essential to streamline your search and get access to more deals.

- From understanding financing options to leveraging the expertise of business brokers, this guide offers practical steps to help you navigate the buying process.

- This guide assists those seeking to acquire a Portland company, encompassing steps to identify the right business for you.

- A well-defined acquisition criteria, financial readiness, and connections with key players in the market are crucial for a successful acquisition.

- By taking a strategic approach, you can position yourself for success in Portland’s dynamic business environment.

Are you ready to acquire a company in Portland, Oregon? Our simple PDF guide will help you understand the buying process. Finding the right business in this lively area of Oregon needs market knowledge, good planning, and smart choices. In this article, we will give you important steps and tips

Understanding the Portland Marketplace – Buyers, Sellers, Brokers, CPAs, Mergers and Acquisitions Professionals

When you want to buy a business in Portland, understanding the overall marketplace and advisors in the region is key to finding every potential opportunity.

Business brokers in Oregon are very important. They help match buyers with sellers. You should look at exclusive listings, go to industry events, and ask for help from experts like CPAs and M&A specialists. The number one piece of advice is to ask every single M&A professional to get on their new opportunity distribution list. Take as many bats as possible when it comes to evaluating a potential business purchase!

Make Friends with Deal Makers to Find Listings – Portland, Vancouver, and Beyond

Networking is a very useful tool for any professional, and buying a business is included. You should talk to deal makers like brokers, attorneys, CPAs, bankers, and M&A professionals in Portland and Vancouver. Go to industry events, join online groups, and find chances to meet those who know how to buy and sell businesses. It can also be beneficial to look to there nearby cities like Seattle and Boise, some large business owners will have a regional presence that can be helpful.

Building relationships with these people gives you important information about what is happening in the market. You will learn about possible chances and get good advice that can help you. These connections can also lead to deals that you won’t find on public lists.

Always remember, a strong network is key in a tough market. So, work on making relationships with deal makers who can help you in your journey to acquire a business.

Set up Online Marketplace Alerts for Oregon

In the digital world, websites like BizBuySell, EmpireBuilders.com, and local business broker sites focus on exclusive business listings. Set up alerts on these platforms to be among the first to discover new listings that match your interests. Stay ahead by actively monitoring and contacting sellers promptly for a faster search process.

Preparing to Buy a Business – Where to Begin and Get Financing?

Thorough preparation is key to buying a successful business. Before you start looking for an acquisition, you need to know your financial limits. It’s also important to do due diligence. This means you should research various industries, study market trends, and get advice from legal and financial experts. This will help you make smart choices.

Buying a business is a big investment, in terms of time, personal wealth, and family capital. Careful preparation can lower risks and help the deal go smoothly.

How to Get Financed for a Business? Big Banks, Regional Banks, or Local Credit Unions

Securing the right financing is usually one of the first challenges a purchaser faces when buying a company. Check different financing options from big banks, regional banks, and local credit unions. Each lender has different terms, interest rates, and requirements. So, it’s important to compare them before deciding.

Think about things like down payment amounts, loan lengths, and how comfortable you feel with the lender. Getting pre-approved for a loan is a smart move. It helps you know your budget and gives you an edge when talking to sellers.

Make sure to talk to several lenders and look at various financing choices. This will help you find the best terms for your purchase.

Personal Financial Capability – Balance Risk vs Reward

Before putting in an offer, evaluate your finances. Assess your assets, liabilities, income, and expenses to determine your investment capacity and risk tolerance. Consider working capital for daily operations, renovations, and hidden costs. Balance risk and reward by aligning your financial situation with long-term goals for a smart investment choice.

Consider a Business Partner

If the price target you want is too high for your budget, think about getting a business partner. A partner can help you with the costs and bring in useful skills and experience.

When picking a partner, find someone you trust. Look for someone whose values and goals are similar to yours. It’s also important they understand the industry you are entering.

Having a partner can improve your financial situation. They can give support, different views, and share the work during the process of buying the business and after.

Step-by-Step Guide to Buying a Business

Navigating the buying process needs a clear plan to prevent costly errors. By following simple steps, you can make your search, evaluation, negotiation, and closing easier. This will help you be more successful.

This guide will break down the buying process. It gives you a clear path to follow. You will stay focused, organized, and confident at every stage. From research to closing the deal, sticking to these steps will lead to a smooth and successful business acquisition.

Step 1: Establish Acquisition Target Criteria

Identifying the right company to buy in Portland, Oregon, starts with setting clear goals. First, do some thorough research throughout Oregon. Look for businesses that meet your goals. You should create a list of key points like price, industry, and size of the business. Use resources like exclusive business listings and business brokers of Oregon to find the best opportunities. Having clear goals early in the buying process will help make your search easier. This way, you can quickly find a good match.

Step 2: Conduct Research on Industry Performance and Comps

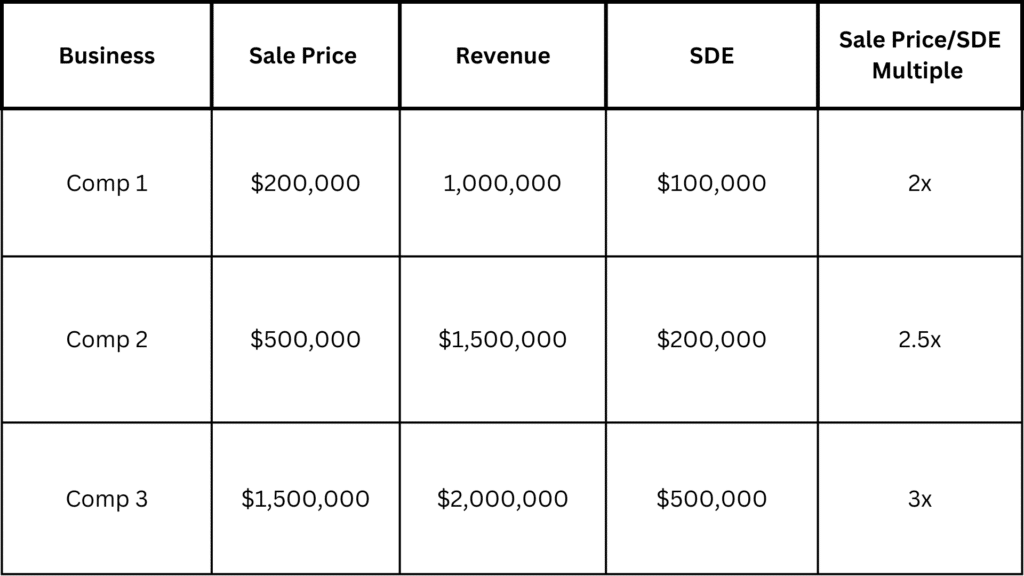

After identifying your ideal target, it is essential to conduct thorough research on industry performance and comparable transactions to establish a reasonable price range. Evaluate industry trends, growth possibilities, and potential risks. Utilize online sources, industry analyses, and financial databases to collect information on similar businesses that have recently been sold (“comps”) in your chosen industry.

Below is an illustration of how you can display comps data:

The more solid and reliable its earning, the more robust its customer base and vendors, the better the management team, and overall marketplace dynamics, the higher the SDE or EBITDA multiple. For capital intensive businesses, the pricing multiple is typical on the low end, whereas a service business with low customer churn, high annual recurring revenue, and a competitive moat built will trade on a higher multiple (e.g. SaaS business with greater than $1M in ARR/MRR).

Focus on crucial financial indicators like revenue, cash flow, and profitability to grasp the financial well-being and market value of comparable businesses. This data will play a vital role in negotiations and assist in determining a fair and appropriate offer, both in terms of price and deal terms to cover future cashflow risks.

Step 3: Connect with Sellers – Sign NDAs, Get the CIM/CBR

Contact businesses and sellers that meet your criteria, either through brokers or directly with the owners. Finding off market opportunities is difficult, as owners of successful companies are cold called regularly about a potential sale. Maintain a professional and polite approach to show genuine interest. Signing NDAs is crucial to protect business information before accessing CIM or CBR for vital details. Establishing trust with sellers is key for smooth negotiations.

Step 4: Request Financial Performance and Qualitative Data

Requesting financial performance, tax records, and KPIs is a key step in evaluating a purchase price to buy a business. You should look at the numbers and understand the brand’s reputation and its customers. This will help you make a smart decision. Review the financial statements, cash flow, and future plans carefully. Also, check things like how people see the brand, if the owner is active in the business or absentee, and where it stands in the market. Talk to the owners if you have questions about anything unclear. This step is important to see if the business meets what you need for a good purchase. Keep in mind that being careful now can help prevent regrets later.

Step 5: Perform a Valuation Based Upon the Data and Make an Offer

To value a business, analyze financial data and key information using methods like discounted cash flow, asset-based valuation, or comparable company analysis to determine a fair market value. Exit Equity offers business valuations in Portland, Oregon, helping business owners navigate the processes of mergers & acquisitions, estate and gift tax, and litigation support. Watch the video with our friend Erin from Upkeeping.co as she lays out all the accounting strategies she uses! When making an offer, specify the price, payment terms, and conditions based on thorough research and market value. Prepare for negotiations with clear communication and be ready for multiple rounds of offers. Define your lowest acceptable offer and seek legal advice during negotiations.

Step 6: Offer Accepted – Start Due Diligence

Congratulations on your accepted offer! Now, the real fun begins with due diligence and negotiating an asset purchase agreement or stock sale. Hire experts like attorneys and accountants to review financial records, contracts, and other important documents. This detailed review uncovers potential problems or risks, ensuring you understand the financial and legal status. Thorough due diligence is essential for making informed decisions and confidently moving towards closing the deal.

If you want to buy a business in Portland, Oregon, you need to know the market and be ready with your finances. It is important to network with deal makers and set up alerts for opportunities. You should also have clear goals for what kind of company you want to buy. By talking to sellers, researching well, and looking at the data, you can make good choices as you move forward. Due diligence is very important before you close any deal. Keep up with how the industry is doing and get professional help when needed. Whether this is your first time buying or you have done it before, this step-by-step guide can make things easier for you. Subscribe to get more tips on buying a business or learn more about our Process in the Role of a Business Broker.

Frequently Asked Questions – How to Buy a Business in Portland Oregon

What are a few great key terms to use when searching the internet to find sellers, brokers, CPA, and legal M&A pros?

When you look for sellers, use keywords such as “businesses for sale” or “business acquisition opportunities.” If you’re searching for brokers, try “business brokers in Portland, Vancouver, Salem, Eugene.” For CPA and legal M&A professionals, use “M&A advisors” or “transaction advisory services.” You can find listings on websites like BizBuySell or join the listing website Axial.

What is a statement of financial capability and how is it used by a buyer to evaluate an offer?

A statement of financial capability shows how much money a buyer has to buy a business. It usually shares details about their assets, debts, and how good they are with credit. This information helps sellers decide if the offer is good and if the buyer can get financing.

What are the common challenges when buying a business in Portland?

Buying in Portland can be tough. You might face challenges like high competition. It can also be hard to find businesses that fit your needs. On top of that, understanding local rules and taxes can be complicated.

Can I buy a business in Portland without a broker?

Buying a company in Portland without a broker is hard, but not impossible. Brokers know the market well. They also have access to listings and help with negotiations. This makes the buying process easier.

What are a few unconventional ways to finance an acquisition? Will a seller accept these terms?

Exploring choices like seller financing, SBA loans, or looking for investors can be different ways to help pay for buying a company. Sellers might agree to these terms to make the switch easier.

How are tax returns used by a lender when considering an SBA loan to a buyer?

Tax returns are crucial for lenders assessing SBA loan eligibility. They reveal the buyer’s financial health, repayment ability, and compliance with tax laws. Lenders analyze these returns to gauge risk and verify income, supporting the buyer’s loan application.