It’s common for owners of manufacturing businesses to start dreaming about their next chapter—retirement, a career change, succession planning, finding the right buyers, taking a break –but not have an idea about where to begin or how to sell a manufacturing business. This is not uncommon! Running a manufacturing business, improving operational efficiency, and constantly innovating for customers is a normal course of business, but unless you purchased your business, or went through a transaction process at another point in life, this is likely the first time an owner will go through the mergers and acquisitions process.

This guide is intended for privately-held business owners, to help demystify the selling process, and answer all the commonly asked questions we routinely receive from our clients. The more you prepare your business to sell, the fewer pitfalls, hurdles, challenges, and deal killers you will encounter along the way.

When Should I Start Preparing my Manufacturing Business for a Sale?

As a general rule of thumb, we encourage our business-owning clients to start preparing for the sale of their business FIVE years before they think they are ready to execute a transaction. Before you begin putting a plan in place, you need to understand if your business is your job or if your business has transferable value.

Determine if your Business is Sellable – Does it have Transferable Value?

There are two types of manufacturing businesses in this world – ones that are able to sell, and ones that are not. The difference between the two is determined by the transferrable value of the business.

Transferable value is the intangible value of a business over and beyond its fixed and hard asset costs. From a potential buyer’s perspective, transferrable value is the ability of a business to generate the same profit without the current business owner. Key questions to reflect on:

- Is your business able to run without you?

- Can you go on vacation without a laptop?

- Are you the key to sales relationships?

- Can vendors and employees be paid without the owners in the office?

- Do suppliers only call your cell phone?

- Are you the primary point of escalation for all operational issues?

From a buyer’s point of a view there is a huge difference between a company with strong management and leadership versus a company that only runs while the owner is on the floor, and unfortunately, this likely means processes, sales tactics, tooling, inventory control, invoicing, etc. is all tribal knowledge and in the owner’s head alone. Manufacturing companies that solely rely on the owner to run the day to today will be hard-pressed to sell for more than the asset value. Transferable value is the key to walking away with a nice lump sum at the end of your career.

Now that you have determined that you A) have transferable value or B) you want to create transferable value, follow this timeline to sell your manufacturing business:

Key Tasks to Prepare Your Manufacturing Business for Sale

- Get a valuation done by a business broker that has experience with manufacturing companies. Don’t have 5 years to wait? Get this done asap – This gives your tangible goals posts and targets to sell your business. If you do anything – do this step. It’s money well spent.

- Clean up the Books – Ensure your financial records are up to snuff – clean, timely, standard, uniform, and accurate financials.

Inventory – if you haven’t started – create and stick to your process for inventory counts commensurate with your industry (1x year, quarterly). I know you don’t want to hear it—but throw all that old inventory away. If you haven’t used it in a few years, buyers won’t want to buy it. Start getting it off your Balance Sheet. - Tidy your Facility – Does your team follow the 5S Methodology to ensure a safe, efficient, and clean facility? Does your team tidy their areas before they leave each day? Are there marked areas on the ground? Take some time to tidy up the facilities—this will improve value, and also will boost morale for your team in the meantime.

- Maintain machinery – don’t over-buy! Ensure you are maintaining your machinery and keeping records. Now is not the time to purchase an expensive machine that won’t be fully utilized—you’ll likely have to pay off the loan on the machine, decreasing the money in your pocket.

- Record, and refresh processes – How are your employee handbooks? Daily processes? The more these are captured, and up-to-date (and there’s a process to keep it up-to-date) the more value a buyer will see in your business.

Start working yourself out of the day-to-day – See ‘Transferable Value’ above. The less you manage the day-to-day, the better. Delegate to your team, and reward them for their upped responsibilities. - Comply with environmental laws in your area – Ensure you are disposing of, recording, and handling materials in line with your local laws. If not, this could delay a sale…or make your business unsellable if there is too much liability for a new buyer.

Consider your long-term lease circumstances – About ready to sign a 10-year lease but want to be retired in two years? Align your exit planning to your long-term lease obligations the best you can.

What is My Manufacturing Business Worth?

Valuations are an art and a science that relies solely on the inputs of your business: your financial records of the past five years, federal income taxes, capital expenditures (past and future), inventory, vendor and customer contracts (or long-term relationships), intellectual property, trade secrets. Everything previously listed are inputs into the calculations of value and will impact the range a potential buyer could offer to buy your business.

The three main buckets that are used to calculate the value of your manufacturing business are:

- Cost – In simplest terms, cost of assets minus liabilities

- Market – Comparable businesses sold in your industry

- Income – How much bottom line profit a company has historically generated and what that means for future cash flow

Business value is not completely derived from financial performance, but also from qualitative factors. We ask clients to complete a questionnaire that generates a scorecard, which in turn influences the multiples and discount rates that heavily influence the final valuation. Our questionnaire considers the following:

- Competitive and industry landscape, opportunities, and threats

- Customer, product, services, and vendor diversification

- Trade and intellectual property

- Quality of employee, leadership, machinery, tooling, technology, systems, and processes

- Financing environment

Get additional information on business valuations here.

Why Get a Valuation Performed on my Manufacturing Business?

Would you rather work towards a well-defined goal or a nebulous one? By having a valuation, or calculation of value, performed on your business 3-5 years before you anticipate selling your manufacturing business, you are getting a real, unbiased, 3rd party analysis of what your business is worth today, which means you can set realistic goals on a future company sale.

Exit Planning Valuation Strategies

- A Calculation of value performed by a business broker or business intermediary that has experience selling manufacturing businesses. Why? Because they are sharing with you a price that they know is reasonable to achieve in the open market. Plus it’s a nice way to start building trust with a business advisor that can help guide you through the full transaction process.

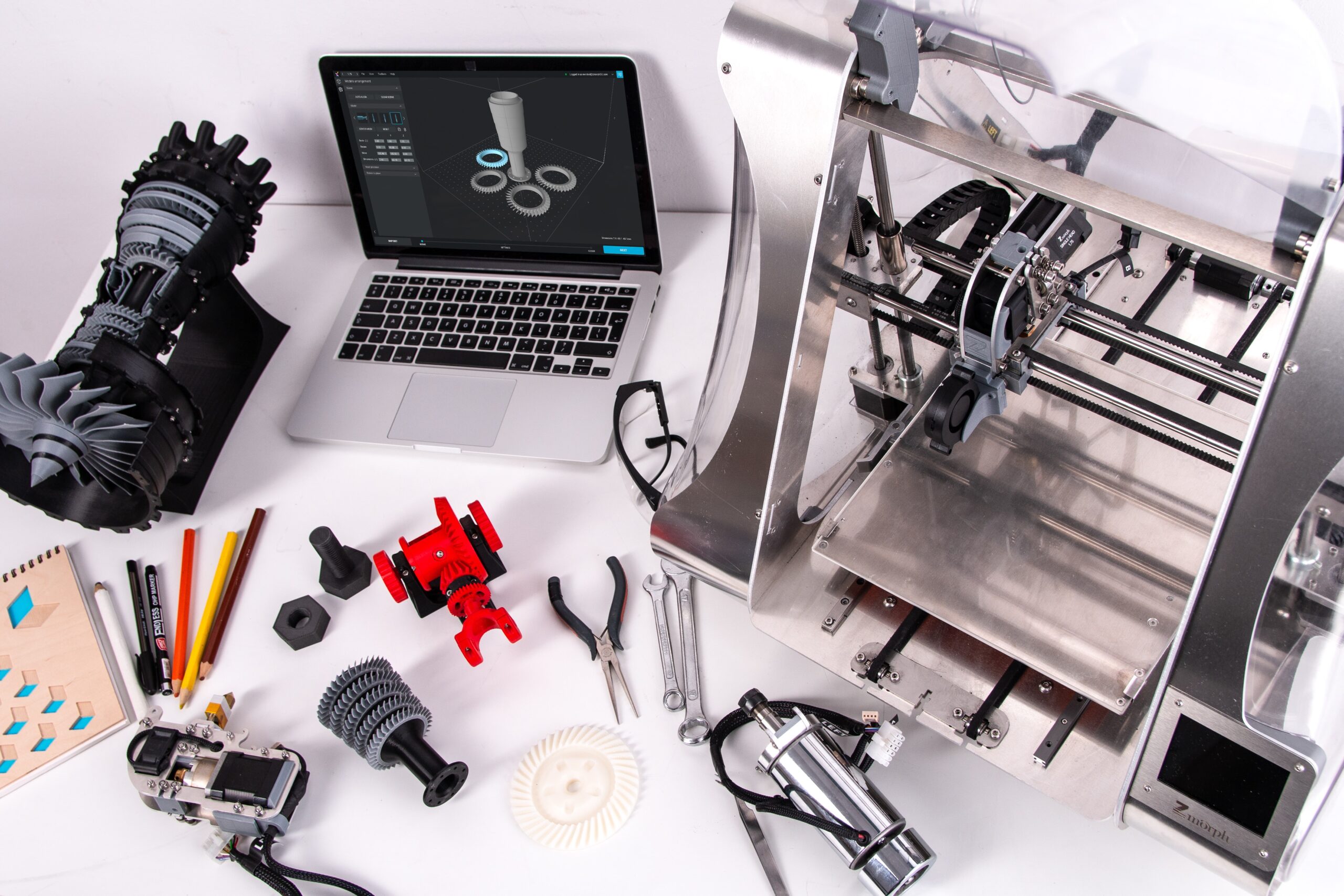

- PAY to get a valuation done. It’s money well spent. A robust valuation typically takes 20 to 30 hours to complete. Avoid a “Free” valuation, you get what you pay for here in terms of quality, attention to detail, and customer service. You do not want a “One Size Fits All” type of analysis for your manufacturing business. There is an enormous difference between a small, generic machine shop and, for example, an aerospace component company that is ISO compliant, Boeing vendor approved with water jet cutting, 5-axis CNC, 3D printing capabilities, and thermal, vacuum, vibration, and fatigue testing equipment in-house.

- Make sure you don’t look at only the top line value- but understand what the net-to-you (money in your pocket) will be —taxes, liabilities, working capital, ownership equity split– it all adds up!

Once you have a valuation performed – take it to your financial planner and CPA. Understand if this number will allow you to achieve whatever is next for you—set you up for retirement, for your next career as a semi-pro skier, golfer, or yacht racer, or starting ANOTHER business.

Does this number work? Great! Keep doing what you are doing. Not enough? Work with your business advisor and valuation analyst/M&A advisor to understand how much your net income and owner’s earnings need to improve, what areas of the business need to improve, and where you should double down on existing competitive advantages.

Time is your best friend when you can take a step back from day-to-day operations and put together a long-term exit strategy and mileposts for progress well ahead of your target business sale date. Time is your enemy if you are forced to make a fire sale on your business.

One last key point is to watch the greater macroeconomic business cycle, trends within your industry, and its impact on M&A activity, such as in a downturn economy or bull market. A valuation is only good at the point and time of the assessment. Customers and profits eb and flow. If you take your foot off the gas pedal, the value declines. If you get a valuation performed well in advance, it is possible to move up the timetable to sell if fortuitous circumstances befall your industry (e.g. toilet paper businesses in April 2020, transportation companies during the 2021 supply chain, and transportation crunch, private equity industry roll-ups, recession-proof businesses, etc.).

Who Would Buy My Manufacturing Business?

To position a company for sale and receive as many offers as possible, we consider the three buyer personas for small/mid-sized businesses:

- Financial

- Strategic

- Synergistic

Generally speaking, financial buyers are purchasing a business so that they can fund their lives and take care of a family. Strategic buyers could be purchasing a business to add new capability or geographic footprint. Synergistic buyers are looking at how the sum of parts is greater than the whole, most likely a platform add-on within a private equity roll-up.

We typically see businesses with greater than $1M EBITDA and a very specific, differentiated niche gain attraction from private equity or much larger acquisition players. Less than $1M EBITDA will likely see interest from competitors, local/adjacent industry customers or vendors looking to add capability, and high-net-worth individuals. Competitors will most often pay the least, or offer the worst terms because they think they can replicate your existing business and are only willing to pay for your customer list.

A manufacturing business that owns property will attract more potential buyers because financing terms become more favorable (over a longer time horizon) as lending institutions will have greater flexibility if both business cash flow and property, as collateral, can be considered in a loan.

Get more information on an in-depth look at these buyer personas, and who is the most likely buyer for you business here.

How Long Will it Take to Sell My Manufacturing Business?

The transaction process can take anywhere from 3-12 months. It is a long, complex, time-consuming process. You need to find not just the right buyer, but also the right deal terms. Any new owner will want to look under the hood during due diligence and make sure there are no existential business risks hidden away. Typically, because manufacturing businesses are asset-heavy, buyers will propose an asset sale.

A general timeline is as follows:

- Initial analysis, Engagement Agreement, Valuation – 2-6 weeks

- Building Marketing Materials and Identifying Buyers – 2-6 weeks

- Shopping the Deal & Buyer-Seller Chemistry Meetings – 1-4 months

- Letter of Intent (LOI) Negotiations – 2-4 weeks

- Due Diligence – 60-120 days

- Purchase and Sale Agreement (PSA) negotiations and Deal Financing – 1- 4 weeks

Broker / Mergers & Acquisition Advisor Fit + Experience

When looking to find the right advisor to help with the sale of your business, you should consider their fit into four major categories:

Culture / Personality Fit

Your advisor is a reflection of you and your business needs to have table manners with all of the critical trusted advisors and buyers of all shapes and sizes.

Industry Background & Competence

Some industry background is required, but not expected to be a complete subject matter expert. It is more important that the advisor understands how to execute a transaction end to end.

Ability and Willingness to Learn

Every business and industry is different, along with the economic conditions that could help or hinder the efforts to sell. The advisor must have the drive to learn about the company, industry, buyer base, new methods, and technology to build the biggest, most robust marketplace for locating buyers. The advisor must have the humility to know that what worked in the past will not always work in the future.

Build Trust

Your M&A advisor must be able to build trust quickly with internal stakeholders, key advisors, and potential buyers. We strive to always start with the client, dive deep into company operations, take ownership of the sales process, and have a sense of urgency to always be moving the company sale forward.

We at Exit Equity have sold aerospace plastic, hydraulic pump, spray technology, machine shops, electronic components, cabling/telecom, testing equipment, window, door, millwork, electronic, prefabricated homes, agricultural input/tooling, medical device, and, drug/supplement/ compound production companies.

Manufacturing Businesses Exit Equity Has Sold:

Custom Choice Door provides residential and multi-family housing industry products such as interior, exterior doors, and interior finishings: millwork, hardware, shelving, mantels, stair parts, and cabinets. The owners built the company to the point where they needed help scaling future growth. The new owners, a $180 million company, found our client’s business model fit nicely into their Northwest building supplies and materials business expansion.

American Spray Technologies (AST) manufacture texture spray machines that drywall contractors depend on. AST rigs reduce job time and make spraying easy with powerful, reliable performance. The owners sought a liquidity event for both the business and the facility to move into retirement.

Commercial Plastics is a custom manufacturing and fabrication of plastic products. Specialties include sales and marketing displays, CNC machining, and large-format digital printing. After owning this successful business for his entire career, the owner was ready to retire and spend more time with their family.

DABS Manufacturing & Assembly is a second-generation aerospace manufacturing & assembly certified (AS9100 & ISO9001) to assemble aerospace parts and components for customers from all around the world. Their customers supply both large aerospace and auto industry companies. The young owner chose to divest to follow his passion in another industry but wanted to preserve the culture of the employees. Between multiple buyers, the owner chose an industry-experienced acquirer.

AM Systems Inc is a non-human use medical product manufacturing company d that distributes and sells its products worldwide B2B and B2C. The transaction included business, facility, and expansion land in an all-cash closing. The retiring owner sought a liquidity event that would facilitate a valued employee’s dream of ownership and enhance the family’s philanthropic work.

Top 5 Tips to Sell a Manufacturing Business

If you can concentrate on only five things to ready your business for a company sale, these should take priority:

- Reliable and growing positive cash flow

- Key performance ratios in line with industry norms

- Clean, accurate, and tidy financial records

- Well-maintained facilities and equipment

- Time the company sale when the company is at a high point